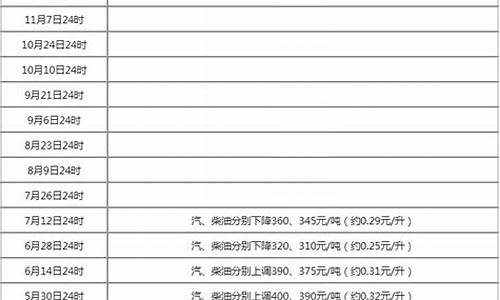

美国银行会倒闭吗_美国银行倒闭冲击金价

1.美国银行接连倒闭是否会击垮经济

2.美国银行倒闭意味着什么

3.美国银行倒闭是怎么回事?

4.美国银行倒闭对我们的影响

不会。

1、首先,美国银行作为跨国银行,在全球范围内分布有许多分支机构和子公司,其业务和风险分散度较高,即使出现问题,也不会影响整个金融系统的稳定性。

2、其次,现代金融市场已经具备了完善的监管体系和应急机制,能够及时发现和处置风险,防止金融危机的爆发和扩散。

3、再者,中国和美国在金融领域的联系和互动越来越紧密,但中国金融市场的发展和稳定性不仅仅受单一国家或企业的影响,各种因素共同作用,综合因素才会产生决定性的影响。

4、综上所述,尽管美国银行的倒闭可能会引起一定程度的金融震荡,但它不会直接导致中国金融系统的危机,我们应该保持理性和稳定,增强风险意识,加强金融监管和管理,防范金融风险。

美国银行接连倒闭是否会击垮经济

美国又有一家银行面临破产的风险,第一共和国银行已经走到了破产边缘,被他拖垮的还有众多银行资本家,就在上个月,美国11家大型银行才刚刚向第一共和国银行注入300亿美元存款,如果第一共和国银行破产,还不知道会不会有进一步的连锁反应。

起初大家认为美国加息是收割全球美国加息是众多经济学家早在几年前就已经预测好的,目的是通过加息行为,吸引全球资本回美国。很多经济学家,还把这种行为理解为美国在收割全球的韭菜。比如:针对中国,美国加息可以导致中国外汇外流美国;针对欧盟,可以令美元升值,让由美元定价的欧洲必需品——石油和天然气价格上涨,起到敲打欧盟的作用;同时,还会让很多小国家资本外流,本币信用度下降,让美元重回霸权地位。

加息让美国骑虎难下,中国却是老虎骑士然而,美国加息似乎每一脚都踩到坑里。一季度,美国GDP增长只有1%,当时通胀率接近6%,美债利息已经飙到4.3%,如果要靠加息抵消通胀率,得加息到6%,这简直是天方夜谭。美国为啥这么倒霉呢?

第一个坑,中国宣布数字货币交易非法,这导致全球数字货币市场动荡,各种数字货币暴跌,暴跌导致锁定在数字资产的美金,回流美国市场,加剧通货膨胀。

第二个坑,中国反其道行之,别国跟着加息,中国反而宣布降准,不仅不收拢资金,反而释放资金,进一步导致美元回流美国。

第三个坑,中国和日本持续抛售美债,美债都被美国人自己接盘了,一边是高昂的利息要支付,另一边是依然压不住的通货膨胀,这些压力就都到了银行业这里了。

加息引发银行业盈利能力下降加息意味着大家不用投资,只需要把钱放在银行里就可以盈利。通胀又让企业投资利益受损,进一步收紧投资,不贷款了。这样一来,银行拿着大笔资金要支付储户的利息,另一方面,贷款发放不出去,导致收支不平衡,面临亏损。所以大量银行又把钱投入利息高昂的美债,成为了美债的接盘侠。

然而,美国舆论是不受控制的,关于银行亏掉本金的谣言一旦开始传播,美国人就开始疯狂的挤兑。这样就导致美国的银行接连出现问题,之前有硅谷银行,现在是第一共和国银行,故事基本都如出一辙。

中国不加息,其实是对的。不知道有没有和我一样是做生意的朋友。此前,我们小微企业要到银行贷款,求爷爷告奶奶都不一定能贷到。但是最近,银行开始给我们企业主打电话,主动推销贷款业务,而且授信额度还不低。不加息,正好是在这个大家都不怎么敢投资的时期,降低银行盈利压力的正确手段。美式金融学,这一次,反而没有显露出我们中国人的智慧。

英文版:Why do banks in the United States go bankrupt so easily? Crazy interest rate hikes, bringing down capitalists.Another U.S. bank is at risk of bankruptcy. First Republic Bank has already reached the brink of bankruptcy, dragging down numerous bank capitalists with it. Just last month, 11 large U.S. banks injected $30 billion in deposits into First Republic Bank. If First Republic Bank goes bankrupt, it is unclear whether there will be further chain reactions.

At first, people thought that the U.S. interest rate hike was to reap benefits from around the world.

The U.S. interest rate hike was predicted by many economists several years ago, with the aim of attracting global capital back to the United States through this action. Many economists also interpret this behavior as the United States reaping benefits from around the world. For example, regarding China, the interest rate hike can cause China's foreign exchange to flow out to the United States; concerning the European Union, it can cause the appreciation of the dollar, leading to price increases for European necessities priced-in dollars such as oil and natural gas, thereby putting pressure on the European Union. At the same time, it will cause capital outflow from many small countries, lead to a decrease in domestic currency credit ratings, and allow the U.S. dollar to regain its dominant position.

Raising interest rates has made it difficult for the United States to get off its tiger, but China is instead a knight riding on a tiger.However, the U.S. interest rate hike seems to have stumbled at every step. In the first quarter, U.S. GDP growth was only 1%, while inflation was close to 6% and U.S. bond interest rates had soared to 4.3%. If they were to use interest rate hikes to counteract inflation, they would need to raise interest rates to 6%, which is simply impossible. Why is the United States so unlucky?

The first stumbling block was when China announced that cryptocurrency transactions were illegal, which caused turmoil in the global digital currency market. Various digital currencies plummeted, leading to a flow of US dollars locked in digital assets back into the American market, exacerbating inflation.

The second stumbling block was when China did the opposite of other countries by announcing a reserve requirement ratio cut. Instead of tightening up funds, it released funds, further leading to a flow of US dollars back into the United States.

The third stumbling block was when China and Japan continued to sell off U.S. bonds, which were then picked up by Americans themselves. The pressure of high interest payments on one hand and unstoppable inflation on the other all came down to the banking industry.

Interest rate hikes have caused a decline in the profitability of the banking industry.Interest rate hikes mean that people don't need to invest, they can simply earn profits by keeping their money in the bank. However, inflation damages investment interests of enterprises, which further tightens up investment and leads to lower lending. As a result, banks have to pay interest to depositors on one hand but are unable to issue loans, resulting in an imbalance of income and expenses and facing losses. So many banks invest their funds in high-interest U.S. bonds, becoming the buyers of those bonds.

However, the American media is uncontrollable, and once rumors begin to spread about banks losing their capital, Americans begin to frantically run on banks. This results in a wave of problems for U.S. banks, first Silicon Valley Bank, now First Republic Bank, all following similar patterns.

It's right for China not to raise interest rates. I wonder if anyone else, like me, is doing business. In the past, small and micro-enterprises had a hard time getting loans from banks, even after begging and pleading. But recently, banks have been calling us entrepreneurs to actively promote their loan businesses, and the credit limits are not low. Not raising interest rates is a correct approach to reduce banking profitability pressure during this period when few people dare to invest. The American-style finance, this time, has not shown wisdom like our Chinese.

美国银行倒闭意味着什么

不会。

美国银行接连倒闭会对经济产生一定的影响,但并不会击垮经济。事实上,美国政府一直在采取措施来保护储户和投资者免受银行业危机的影响。美国政府还采取了一系列措施来稳定金融市场,包括加强监管、提高透明度、加强流动性支持等。

美国银行倒闭是怎么回事?

首先,对硅谷的科技公司影响很大。硅谷科技公司在硅谷银行的存款必然遭受损失。关闭硅谷银行会对企业的大额账户或信用额度产生巨大影响。联邦存款保险公司对每个账户的最高承保额是25万美元。该机构表示,截至去年底,硅谷银行总资产约为2090亿美元,存款总额约为1754亿美元。硅谷银行的存款主要来自企业科技公司,硅谷科技公司的存款有几百万美元,最高25万美元的承销金额只是科技公司在硅谷银行存款的零头。其次,硅谷银行主要服务于科技型企业。商业模式是:向早期初创企业发放贷款并收取较高利息,通过协议获得部分股票期权或期权;对于有前景的初创企业,硅银集团还会让旗下的硅银创投以风险投资的方式介入,获得资本增值。硅谷银行的破产说明美国科技公司近年来创业成绩不佳,美国硅谷的科技公司已经找不到新的经济增长点。第三,硅谷银行是美国第16大银行。这是2008年金融危机后倒闭的最大的美国银行,自美联储去年开始加息以来,它受到了沉重打击。目前,硅谷银行的倒闭正在拖累整个美国银行业。第四,硅谷银行破产意味着美国经济陷入严重衰退。只有大量实体产业出现问题,银行才会破产。金融机构是经济发展的最后一道防线。一旦银行破产,经济衰退不可避免。第五,美国硅谷银行破产背后的深层次原因是美国经济衰退,必然影响世界经济。数字经济经济学学派的底层逻辑是产业集群,产业集群可以通过数字经济进行整合和升级。面对全球经济衰退,我们应该加快运用数字经济经济学的学派来解决产业升级的问题。

美国银行倒闭对我们的影响

美国银行倒闭的原因有多方面,主要是受到美联储加息、通胀上升、科技股下跌等因素的影响。

储户的资金是否能拿回来,取决于他们在哪家银行存款以及存款金额。美国政府已经采取紧急措施来保护储户和金融稳定。

对于硅谷银行和标志银行的储户,美国财政部、联邦储备委员会和联邦储蓄保险公司已经发表联合声明,承诺向他们提供完全保护,并保证他们可以取回所有存款。

对于其他美国商业银行的储户,在正常情况下,如果他们在同一家银行或同一集团旗下不同机构开设账户,并且账户总额不超过25万美元(约合人民币160万元),那么他们就可以享受联邦储蓄保险公司(FDIC)提供的存款保险服务。如果该机构倒闭或被接管,则FDIC将向其支付最高25万美元(约合人民币160万元)赔偿金。

将加剧两国之间的贸易关系,并导致全球经济的不稳定,这也将影响到中国的出口和进口。

首先,就是可能会影响我们投资理财的收益。一家规模较大的美国银行出现破产,几乎会不可避免地对金融市场形成冲击。因为一家银行破产或许并不可怕,但怕的是一家银行破产可能引发的连锁反应,并引起一大片银行破产。

虽说美国的银行破产主要冲击的是美国股市,但由于美国股市对全球的股市影响较大,所以如果美国股市下跌,其他国家的股市也难保不会受到影响。包括我国的A股在内,都有可能会在美国股市下跌的带动下出现下跌。

其次,就是可能会影响我们的收入。如果一家美国银行破产并引发更大的危机,可能就会重创美国经济。而在经济全球化的今天,世界各国的经济联系都比较紧密,美国作为全球最大经济体,对全球经济的影响更不用说。

声明:本站所有文章资源内容,如无特殊说明或标注,均为采集网络资源。如若本站内容侵犯了原著者的合法权益,可联系本站删除。